Explore the Future of Investing with AI Hedge Fund

Experience cutting-edge technology that can enhance your trading strategy—start your free trial today!

Click here to start your free trial.

Introduction to AI Hedge Fund

In today’s fast-paced financial environment, making informed trading decisions can be overwhelming. Many traders often struggle with data overload and fear of making poor investment choices. Have you faced dilemmas about whether to buy or sell a stock? Or perhaps you find it challenging to interpret market sentiment and trends effectively? The AI Hedge Fund is a tool designed to tackle these pain points by leveraging artificial intelligence to analyze multiple data sources, providing insights that can help you navigate trading uncertainties with greater confidence.

Key Features and Benefits of AI Hedge Fund

- Valuation Agent: Calculates intrinsic stock values based on comprehensive analysis.

- Sentiment Analysis: Gauges market sentiment, helping you understand public perception.

- Fundamental Analysis: Evaluates fundamental data to highlight potential investment opportunities.

- Technical Indicators: Uses past price movements to predict future trends.

- Risk Management: Assesses risk metrics to ensure sensible financial exposure.

- Portfolio Management: Finalizes trading decisions efficiently, creating a balanced investment portfolio.

5 Tips to Maximize Your Use of AI Hedge Fund

- Start by understanding the functionality of each agent to make informed trading decisions.

- Regularly backtest your strategies to assess their effectiveness and adjust where necessary.

- Utilize the sentiment analysis tools to gauge public perception and market outlook before trading.

- Set clear investment goals in conjunction with the risk management features to stay within your risk tolerance.

- Engage with community input from the project repository to improve your knowledge and stay updated on best practices.

How AI Hedge Fund Works

The AI Hedge Fund operates using various agents, each designed to specialize in different areas of analysis. The **Valuation Agent** analyzes price versus intrinsic value; the **Sentiment Agent** processes news headlines and social media chatter to gauge market sentiment; the **Fundamentals Agent** examines balance sheets and earnings reports; and the **Technical Analyst** assesses price trends and patterns. Together, these components generate actionable trading signals. The **Risk Manager** ensures that trading activities remain within acceptable risk levels, while the **Portfolio Manager** ultimately decides on trades to ensure a balanced investment approach.

Real-World Applications of AI Hedge Fund

The AI Hedge Fund can be implemented in various scenarios, including:

– Retail trading, where individual investors can benefit from automated decision-making.

– Institutional trading, where funds can enhance their analysis with real-time data.

– Financial education, serving as a learning tool for students and professionals looking to understand market dynamics.

– Risk assessment in companies that need to evaluate investment opportunities quickly.

Challenges Solved by AI Hedge Fund

The AI Hedge Fund addresses several challenges that traders face:

– Overcoming data overload by synthesizing vast amounts of information into actionable insights.

– Mitigating emotional decision-making through data-driven analyses.

– Providing continuous market monitoring that enables timely reactions to emerging trends.

– Reducing the time required for technical and fundamental analysis.

Ideal Users of AI Hedge Fund

The primary users of the AI Hedge Fund include:

– Individual investors looking for a competitive edge in trading.

– Financial analysts seeking sophisticated tools for deeper analysis.

– Educational institutions that require a practical tool for teaching trading strategies.

– Hedge funds and investment firms aiming to enhance their operational efficiency with AI.

What Sets AI Hedge Fund Apart

Three unique attributes of the AI Hedge Fund include:

– Multifaceted analysis: It combines multiple forms of analysis—valuation, sentiment, fundamentals, and technicals—into one cohesive tool.

– Scalability: Designed to handle various trading volumes, from small-scale personal investments to large institutional trades.

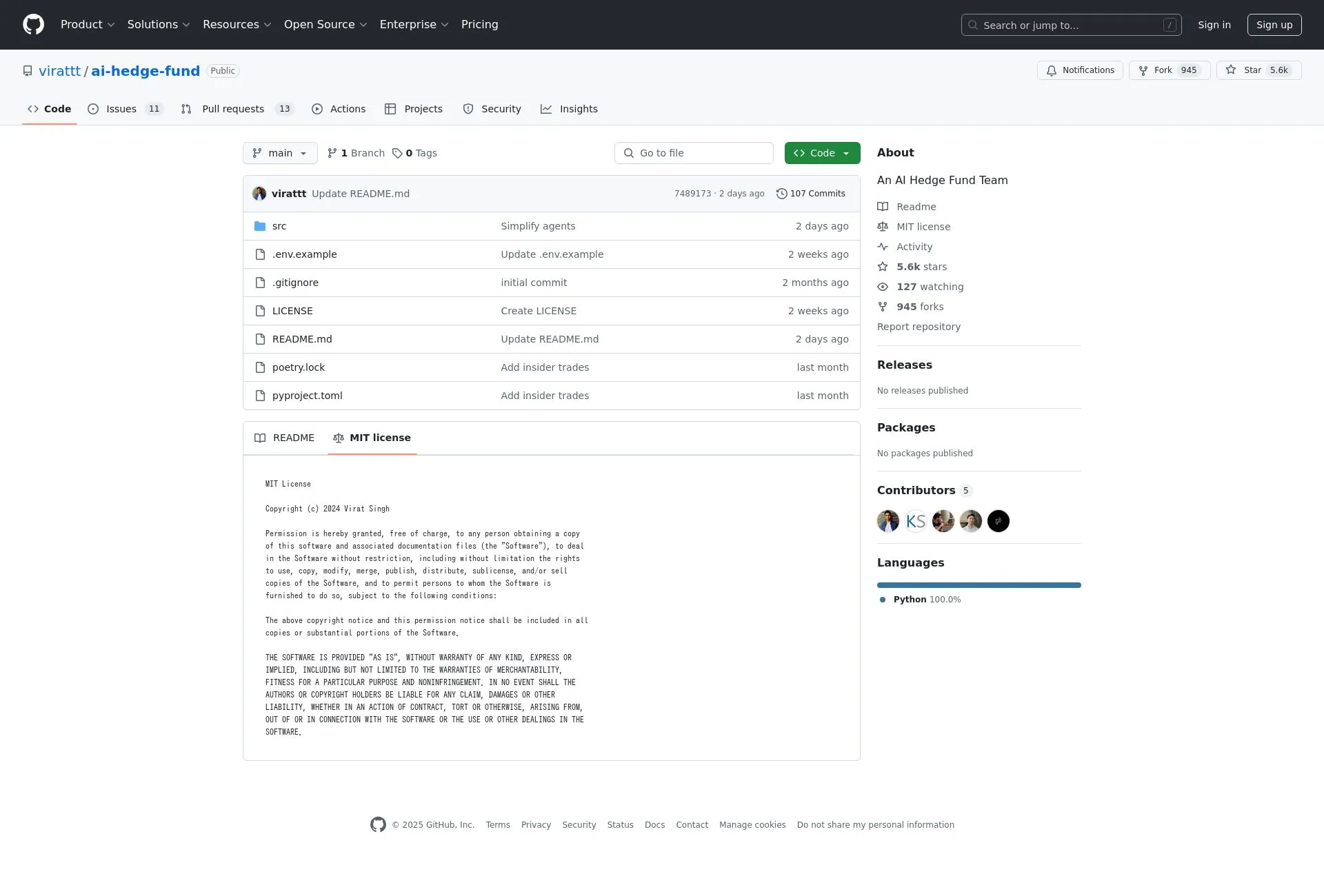

– Community-driven improvement: Continual enhancements and updates are driven by feedback from users and contributors on the project’s repository.

Improving Work-Life Balance with AI Hedge Fund

The AI Hedge Fund enables traders to focus on strategic decision-making rather than getting bogged down by data analysis. By automating many analytical processes, users can allocate their time towards refining their investing strategies, enhancing their understanding of market dynamics, and ultimately achieving a more balanced professional life. The efficiency gained through AI assistance allows for more free time for personal pursuits, without sacrificing investment goals.

“`html

AI Hedge Fund Features

Analysis

Multi-agent system combining technical, fundamental, and sentiment analysis for comprehensive market insights.

Risk

Advanced risk management features to ensure trades stay within acceptable risk tolerance levels.

Portfolio

Automated portfolio management and trade execution for balanced investment allocation.

Smart AI

AI-powered decision making that processes vast amounts of data to generate actionable trading signals.

PopularAiTools.ai

“`